Decentralized Finance (DeFi) – what it is and what it does

Content

What is DeFi?

Decentralized Finance, or DeFi, is a global, open-source alternative to the current financial system with products that let you borrow, save, invest, and trade. DeFi describes a system of financial applications that utilizes blockchain technology's key features such as immutability, decentralization, and smart contracts to create a transparent and accessible financial ecosystem. Unlike traditional financial institutions, which are controlled by central authorities, DeFi creates financial products and services that are open to everyone and cannot be shut down.

DeFi transactions are recorded on a public ledger and are processed using smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. DeFi aims to provide financial services that are more open, transparent, and accessible to everyone, and to give users greater control over their own financial data and assets.

But before you read on, be warned that today’s DeFi ecosystem is like the Wild West – anything goes, and malicious developers have swamped it with scams, hacks and exploits. Check out the Rekt database with more than 2 500 scams, hack and exploit events; the total of all funds lost across all these events, and a full breakdown of all technical issues that occurred.

Examples of DeFi Applications

One example of a DeFi application is a lending and borrowing platform. On these platforms, users can lend or borrow assets such as cryptocurrencies. Smart contracts automatically manage the terms of the loan, such as the interest rate and the duration of the loan, and also automatically enforce the repayment of the loan.

Decentralized exchanges (DEXs) are another type of DeFi application that allow for the trading of cryptocurrencies without the need for a centralized intermediary. Instead, DEXs use smart contracts, which are self-executing digital contracts with the terms of the agreement between buyer and seller being directly written into lines of code, to facilitate trades. DEXs also often have a more permissionless approach, meaning that anyone can list a token and trade it without the need of an intermediary to approve the listing. Moreover, DEXs can be more resistant to censorship, as there is no central point of control. This makes them more accessible to a wider range of users, including those in countries with stricter regulations. Overall, DEXs are seen as a way to promote more open and transparent trading of cryptocurrencies, and as a way to give users more control over their assets.

Then there are decentralized prediction markets, which are digital platforms that enable users to trade contracts based on the outcome of future events, such as elections or sports games. The contracts, known as prediction market tokens (PMT), are bought and sold on the platform, with the value of the PMT determined by the likelihood of the event happening. Users can buy PMTs that correspond to a certain outcome of the event, such as a specific candidate winning an election, and if that outcome occurs, the users will receive a payout. These platforms also allow users to create their own markets, such as predicting the outcome of a specific game or match, which can attract more users and increase liquidity. Overall, decentralized prediction markets are seen as a way to harness the wisdom of the crowd and incentivize accurate predictions through the use of blockchain technology.

Decentralized insurance platforms are a type of DeFi application that allow users to buy and sell insurance products in a decentralized manner, without the need for a traditional insurance company. Instead, these platforms use smart contracts to facilitate the creation, management, and settlement of insurance policies. By using smart contracts, the platform can automate the process of underwriting, claims management, and payouts, reducing the need for intermediaries and minimizing the risk of fraud. Additionally, it can also provide users with more flexibility, as they can buy and sell insurance products at any time and from anywhere. The platform can also help to reduce the cost of insurance, as the lack of intermediaries can lower the administrative costs.

Centralized versus Decentralized Finance

Centralized Finance (CeFi) refers to traditional financial systems that are regulated by a central authority. These regulators, banks and other financial institutions have complete control over the financial system and the transactions that take place within it.

Both CeFi and DeFi have their own advantages and disadvantages. CeFi is typically more regulated and therefore more secure but may also be more expensive and restrictive in terms of the financial products and services offered. On the other hand, DeFi has the potential to reduce fees (which is not the case at the moment) and offer more financial freedom and innovation but may also be less regulated and therefore less secure.

Advantages and Disadvantages of Centralized Finance

Advantages

Regulation: CeFi is typically heavily regulated by governments and security and banking agencies, which provides a certain level of security for consumers and investors. This means that there are rules and regulations in place intended to protect consumers from fraud and other types of financial crimes.

Stability: CeFi is generally considered to be more stable than DeFi because it is backed by governments and licensed financial institutions. This provides a certain level of confidence for consumers and investors.

Accessibility: Basic CeFi products are widely accessible to the general public (at least in developed countries) and is easily understood by most people. This makes it a more mainstream option for those who are new to the world of finance.

Insured: CeFi deposits are insured by government-backed deposit insurance schemes. This means that even if the bank goes bankrupt, depositors will get their money back up to certain limits.

Disadvantages

Lack of innovation: CeFi is typically more restrictive than DeFi in terms of the financial products and services that are offered. This can limit the types of investments and financial services that are available to consumers and varies from country to country.

Lack of transparency: CeFi is often criticized for its lack of transparency, as the opaqueness of the financial products and services offered by banks as well as investment and insurance companies make it hard for customers to understand the true costs and risks associated with these products.

Counterparty Risk: This refers to the risk that the other party in a financial transaction will not fulfill its contractual obligations. For example, if a bank enters into a derivatives contract with another bank, and the other bank becomes insolvent and is unable to fulfill its obligations under the contract, the first bank may suffer a loss.

Lack of access: Large groups of people, especially in the developing world, aren't granted access to set up a bank account or use financial services. According to the World Bank, 1.4 billion people worldwide remain unbanked.

Potential for censorship through central authorities: Financial institutions and payment intermediaries have the ability to shut down accounts or inhibit transactions. Organizations and websites rely on their financial institutions to ensure they can continue to operate by accepting online donations, sell goods online, or simply have a bank account. Cutting them off from financially can have serious ramifications for free expression of lawful speech online.

Advantages and Disadvantages of Decentralized Finance

Advantages

Accessibility: DeFi allows anyone with an internet connection to access financial services, regardless of their location or credit history.

Transparency: DeFi transactions are recorded on the blockchain, making them transparent and auditable.

Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted, providing an added layer of security.

Censorship resistance: DeFi transactions are not controlled by any centralized authority, making them resistant to censorship.

Disadvantages

Complexity: The technology behind DeFi can be complex and difficult for non-technical users to understand.

Volatility: The value of DeFi assets can be highly volatile, leading to potential losses for investors.

Smart contract risks: Smart contracts, the backbone of DeFi, can have bugs or vulnerabilities caused by coding errors that can result in the loss of funds.

Lack of regulation: DeFi is largely unregulated, which could lead to potential fraud or misuse of funds.

Interoperability challenges: DeFi platforms are largely isolated, which makes it difficult to move assets between platforms.

How does DeFi Work?

In DeFi, a smart contract replaces the financial institution in the transaction. That means the rules of the financial transaction are written in code. Once the smart contract is deployed to the blockchain, DeFi dapps (decentralized applications – they are like normal apps, and offer similar functions, but the key difference is that they are run on a peer-to-peer network, such as a blockchain, using smart contracts) can run themselves with little to no human intervention.

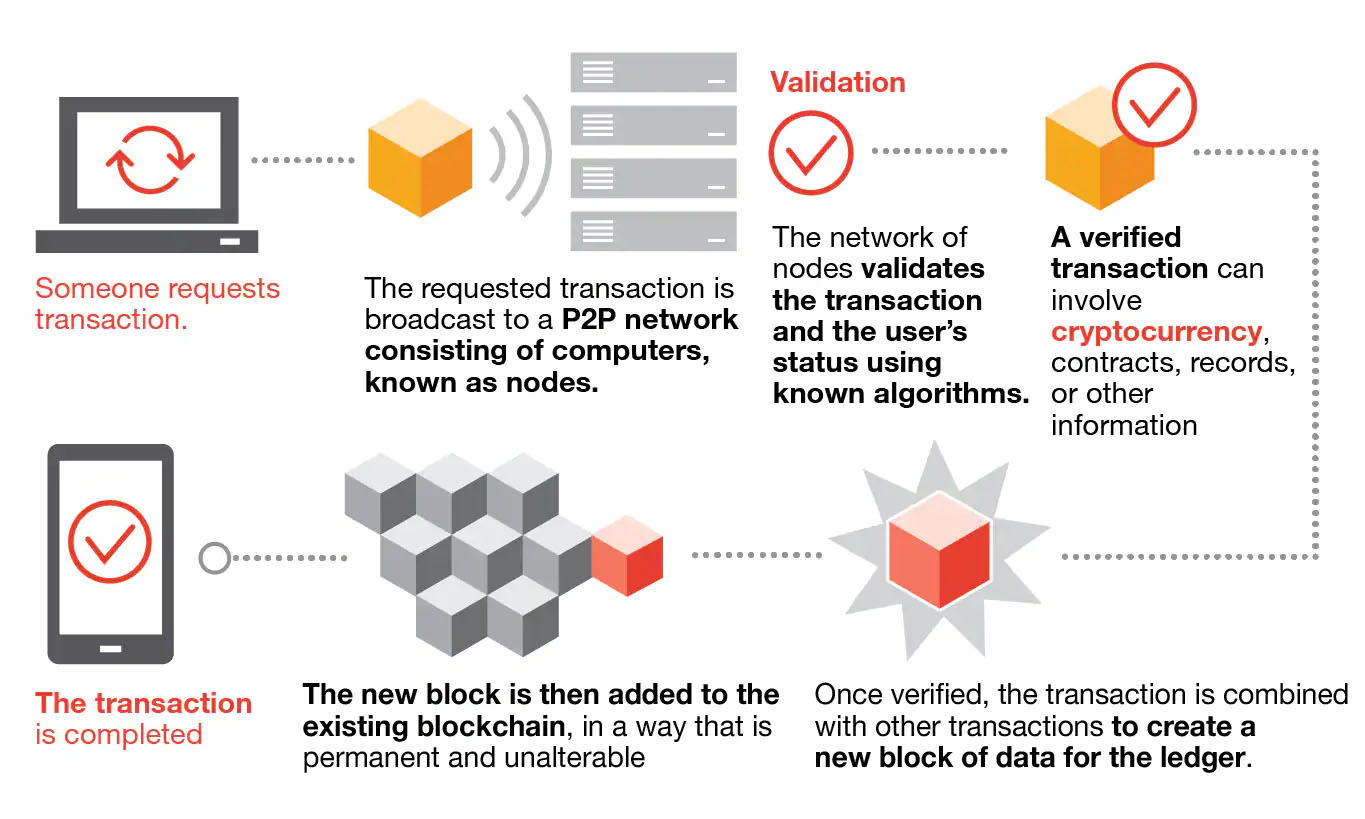

Decentralized finance uses the blockchain technology that cryptocurrencies use. A blockchain is a decentralized ledger of records of transactions (called blocks) across a peer-to-peer network where participants stay anonymous. In other words, blockchains are networks of physical computers that work together to form a single virtual computer. It’s called a chain because changes can be made only by adding new information to the end – which means that each new transaction grows the chain.

The blockchain allows for transparency in the code by making it available for anyone to review and audit. This creates trust among users because they have the ability to understand how the contract works and identify any errors. Additionally, all transactions on the blockchain are publicly visible, which can raise concerns about privacy. However, by default, transactions are not linked to a user's real-world identity, providing some level of anonymity.

DeFi applications are intended to be accessible to users worldwide from the moment they are launched. Users in any location, whether it be Alaska or Zimbabwe, have access to the same DeFi services and networks. However, it's important to note that some local regulations may apply. Technically, most DeFi apps are available to anyone with an internet connection, regardless of their location.

In DeFi, there are no barriers to entry for creating or participating in financial applications. Any individual can create and use these decentralized apps without the need for approvals or lengthy registration processes. Instead, users interact directly with the smart contracts through their crypto wallets.

DeFi Platforms, Exchanges and Protocols

DeFi has the potential to revolutionize the financial industry by reducing costs, increasing efficiency, and improving access to financial services for those who may not have had it before. However, DeFi is still a relatively new and rapidly evolving field, and there are risks and challenges that need to be considered, such as regulatory uncertainty, security vulnerabilities, malicious exploits, and market volatility.

There are several DeFi applications and services that have gained significant traction and have attracted a large user base. Here are a few examples:

These are just a few examples of DeFi applications and services that have gained significant traction and have attracted a large user base. There are many other DeFi platforms and services that have also gained a significant following.

The Position of Central Banks on DeFi

DeFi’s novel way of providing financial services without relying on centralized intermediaries entails specific financial stability risks and regulatory challenges. Whereas central banks are not averse to central bank digital currencies (CBDCs) they appear to have serious reservations about DeFi. CBCDs are digital tokens, similar to cryptocurrency, issued by a central bank and are pegged to the value of that country's fiat currency – which means that the central bank keeps full control. In contrast, DeFi's whole premise is to take that control away from central institutions.

The position of the Federal Reserve (Fed) in the United States towards decentralized finance (DeFi) is one of cautious observation. The Fed has acknowledged the potential benefits of DeFi, such as increased access to financial services and increased transparency, but also has raised concerns about the risks posed by DeFi, such as the potential for fraud and lack of regulation.

The Fed has stated that it is closely monitoring the development of DeFi, and is working with other regulatory agencies to understand the implications of this technology. In general, the Fed has emphasized the importance of maintaining a safe and stable financial system and has indicated that it will take appropriate action to address any risks posed by DeFi.

A paper in the Fed’s Finance and Economics Discussion Series discusses a generic set of stability issues that arise from the provision of financial services on blockchains, and it also highlights some unique concerns arising from the development of DeFi, especially the governance of the code used in dapps.

The authors point out that ”under the scenario in which public blockchains evolve to provide a full range of services denominated in cryptocurrencies, supervisory authorities (including the Federal Reserve) may lack the necessary tools to ensure compliance with laws and regulations. Policies considered well in advance and thoughtfully may reduce the scope of the inevitable financial stability disruptions stemming from DeFi.”

The European Central Bank (ECB) has acknowledged the potential benefits of blockchain technology and has stated that it is "open to exploring the use of distributed ledger technology" for its operations. In a report published in 2019, the ECB stated that "distributed ledger technology could bring benefits to the provision of central bank money and other central bank services."

A Macroprudential Bulletin by the ECB concludes that ”As vulnerabilities start to build, an internationally coordinated approach is needed to mitigate DeFi risks before they pose a risk to financial stability.”

The Bank of Japan (BOJ) has also acknowledged the potential benefits of DeFi and has stated that it is "watching developments in the field closely." In a report published in 2021, the BOJ states that "DeFi has the potential to change the way financial intermediation is conducted and to promote financial inclusion."

The report by the Bank of Japan (BOJ) recognizes the potential benefits of DeFi but also highlights the potential risks associated with it. These risks include:

In its working paper “Cryptocurrencies and Decentralized Finance”, the Bank of International Settlements (BIS) provides a comprehensive discussion of the different ways in which security of transactions is achieved under different protocols of the blockchain technology on which DeFi is based. It also examines the economic incentives built into these protocols. It provides an overview of the current crypto landscape and the main DeFi applications such as decentralized crypto exchanges, borrowing and lending markets, and yield farming.

With regard to risks, the authors emphasize that the permissionless and pseudonymous design of DeFi generates challenges for enforcing tax compliance, anti-money laundering laws, and preventing financial malfeasance. They highlight ways to regulate the DeFi system which would preserve a majority of benefits of the underlying blockchain architecture but support accountability and regulatory compliance.

The People's Bank of China (PBOC) has taken a cautious stance towards DeFi and has issued warnings about the risks posed by this technology. The PBOC has emphasized the importance of maintaining financial stability and has stated that it will take "firm action" against any illegal activities related to DeFi.

In late September 2021, the People’s Bank of China (PBOC) banned all cryptocurrency transactions. The PBOC cited the role of cryptocurrencies in facilitating financial crime as well as posing a growing risk to China’s financial system owing to their highly speculative nature.

It's worth mentioning that central banks are continuously monitoring the developments of the DeFi and its impact on the economy, so their position may change over time.

Conclusion

DeFi offers a range of new financial applications, as part of a broader vision called Web3. To a large extent, it does not create novel financial products, but mimics those provided in traditional financial markets through technology-enabled innovation.

Certain features such as how assets are held, how trust is generated and how the system is governed distinguish DeFi from traditional finance. DeFi is in many ways subject to the same vulnerabilities as traditional finance, including those caused by excessive leverage and risk taking, liquidity mismatches and interconnectedness.

So far, DeFi is not delivering its promised benefits in practice:

To fully benefit from technological advances, regulation of crypto assets, stablecoins and DeFi is urgently needed to address relevant risks.